Insights

Will You or Will you Not

“I don’t have enough assets to worry about a will.” “I’m too young to think about estate planning.” “I’ll get around to it later.” Does

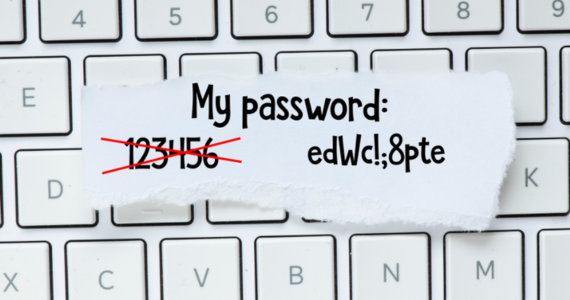

Have you changed your passwords lately?

May 1 is World Password Day and serves as a timely reminder to reset your passwords regularly to help keep yourself safe online. Cybercrime can

Teach your kids money & apps

We all want the best for our kids. Life throws many challenges at them as they grow up, and one that is becoming more and

Making the most of market uncertainty

In recent years and months, market volatility has once again tested the nerves of investors. From the post-COVID recovery to ongoing geopolitical tensions, persistent inflation,

Boost Your Future: How Extra Super Contributions Add Up

With the financial year end approaching, now is the perfect time to consider making additional contributions to your superannuation. Despite rising living costs affecting households

Planning for the inevitable and getting your estate in order

Dying is not something we like to think about, however, a bit of pre-planning can save a lot of heartache for those we leave behind.