Key points

In contrast to last year, the major themes dominating markets in 2025 are:

- Slowing global economic growth as forecast by the International Monetary Fund, mainly due to President Trump’s global tariff war.

- Investor sentiment is low, with many expecting a US recession in 2025, and returns are expected to remain volatile.

- A shift in investor appetite to defensive stocks, bonds and gold away from high growth stocks and riskier assets.

- Opportunities appearing away from the US, e.g. Australia, Europe, the UK, Japan and emerging markets.

- Active managers are finding opportunities as market dynamics change.

The year so far

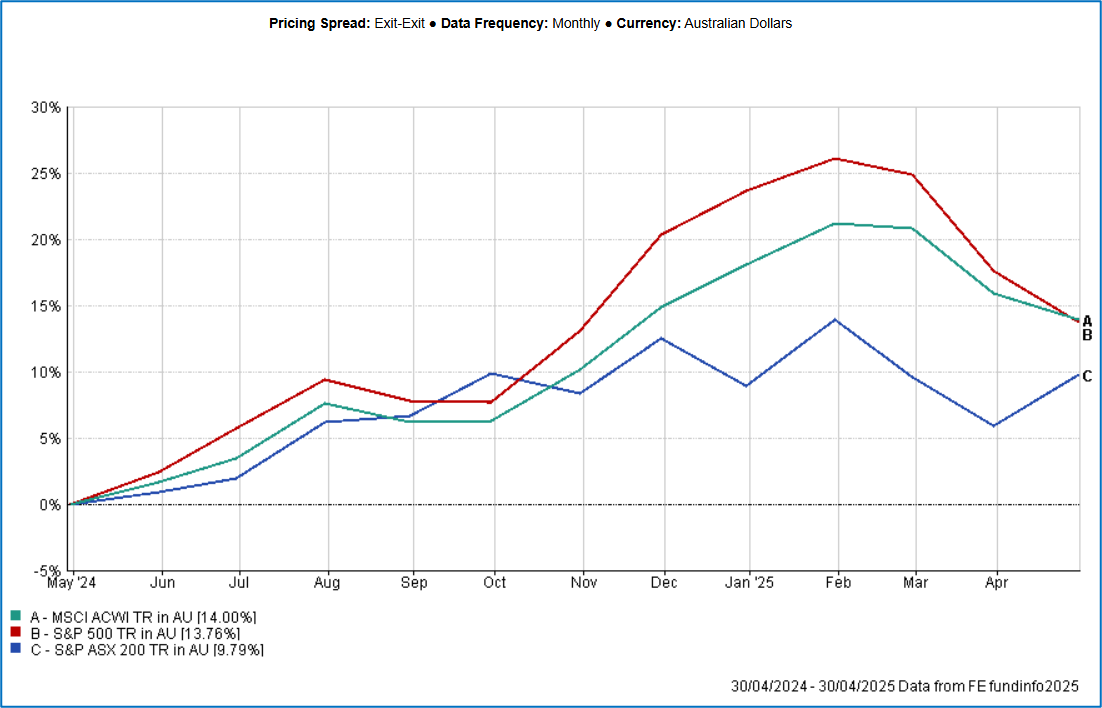

The chart below shows the performance over 1 year to 30 April 2025 for the US stock market (in red); global shares (in green) and Australian shares (in blue).

Share market performance 1 year to 30 April 2025

The theme coming into 2025 was one of US stock market exceptionalism, reflecting both the growth prospects of Artificial Intelligence (AI) related stocks and what was broadly viewed as a pro-growth US Administration.

As the chart starkly shows, this all changed at the end of January when Chinese company DeepSeek unveiled a new AI model, which caused a tech stock rout, followed by the announcement of initial tariffs in early February, which continued into April.

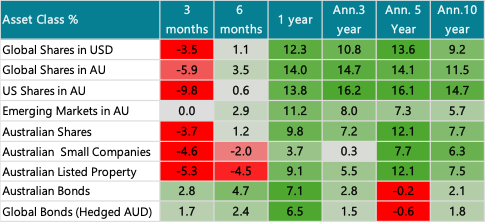

The table below shows negative returns on all share markets over the last 3 months, with global shares down 6% and US Equities (S&P 500) down 10%. Emerging markets have done comparatively well but are quite volatile due to the tariff environment.

The Australian equity market outperformed global markets in April, due to the relatively low impact of US tariffs on Australia and a March Quarter inflation report indicating that inflation has cooled and is under control.

One year returns on growth assets are good except for Australian resources, which did poorly given concerns over China’s growth prospects and falling commodity prices. Bond returns have been volatile but consistently positive across all periods of up to three years.

Returns of major asset classes to 30 April 2025

Outlook for economies and markets

Our base case is that uncertainty will continue to drive market performance in the short term, with returns differing significantly by region or country. Poor investor sentiment is likely to result in modest levels of broad market index returns, as it becomes increasingly difficult for many companies to forecast earnings or make significant investments.

The good news is that there are positive signs for a broadening out of the returns beyond the large cap stocks globally. Australian stocks should benefit as interest rates are predicted to fall further, and especially if the Chinese Government stimulates its economy.

This environment provides opportunities for active managers.

Quality fixed income assets offer reasonable returns at low risk.

Conclusion

Our preferred approach in times of uncertainty is:

- Remain diversified by asset classes

- Ignore short-term noise and stick with your investment strategy

- Active management over passive.

- Bonds and high-quality credit for income and stability.

- Regular rebalancing to maintain target allocations.

The key is to remain invested. While short-term volatility can be uncomfortable, maintaining a long-term perspective and diversified approach remains the best strategy for most investors.

The information contained in this article is general information only. It is not intended to be a recommendation, offer, advice or invitation to purchase, sell or otherwise deal in securities or other investments. Before making any decision in respect to a financial product, you should seek advice from an appropriately qualified professional. We believe that the information contained in this document is accurate. However, we are not specifically licensed to provide tax or legal advice and any information that may relate to you should be confirmed with your tax or legal adviser.